Do you have the life of your dreams? Have you ever imagined a life where you don’t have to work until your 50ish or 60ish, but instead, you can enjoy a comfortable existence, retire early, and live a life you absolutely love? While not everyone is born into wealth or inherits riches, it’s important to know that it’s still possible to achieve your dream life even without a fancy financial background. In fact, there are numerous strategies you can employ to generate passive income and potentially earn a substantial monthly sum of $10,000.

Building passive income is a gradual process, so it’s important to start as early as possible. I assure you that taking the initiative to begin now will be worth it. Today, I’ll share with you a method for generating passive income online that has the potential to help you earn anywhere from $10,000 to $30,000 USD per month. By exploring different options and choosing the one that suits you best, you can pave the way for financial success and the freedom to live life on your own terms.

Let’s dive into ten proven strategies for generating passive income:

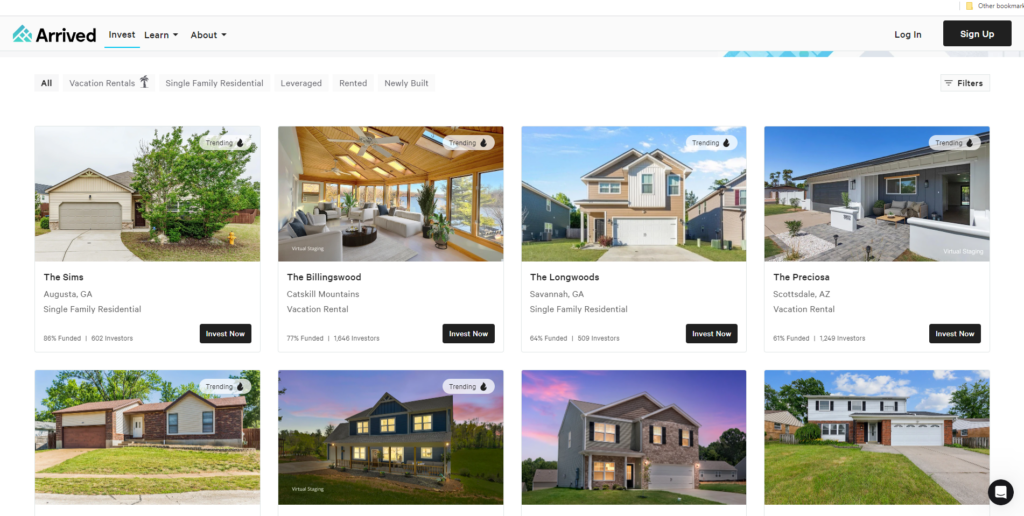

1. Crowdfunding Real Estate:

If you have savings and don’t want to invest all of it in one place, consider exploring the world of crowdfunding real estate. This method involves pooling funds from multiple investors to finance real estate projects. By investing in crowdfunding real estate, your passive income will depend on the appreciation of the property over time. In the United States, property appreciation averages around 5% or more annually. For instance, if you were to invest $10,000 and the value of the property increases, you could potentially earn $10,500 or more. A good point to invest in real estate is you don’t need to worry about your money that much because this is one of the most stable ways to earn money.

To gain further insights into crowdfunding real estate, I highly recommend visiting the website: https://arrived.com/

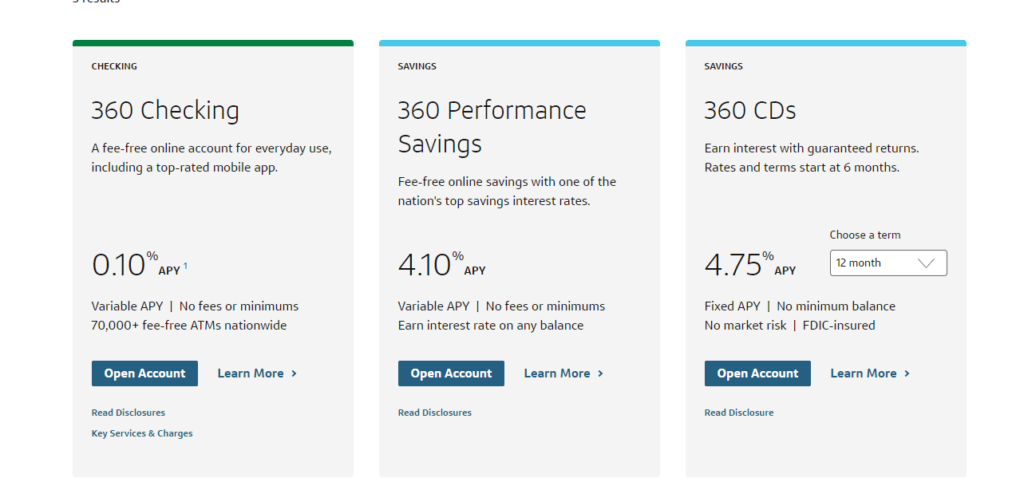

2. High-Interest Checking Accounts:

Instead of letting your hard-earned money sit idle, you can explore the option of opening a high-interest checking account. These specialized accounts offer higher interest rates compared to traditional checking accounts, enabling your money to grow over time. It’s crucial to thoroughly research and compare the Annual Percentage Yield (APY), terms, and conditions offered by various financial institutions. Additionally, it’s important to ensure that the bank you choose has a stable financial background. For example, if you deposit $10,000 in an account with a 5% APY, you could potentially earn $10,050 by the end of the year.

You can explore high-interest checking account options on websites such as:

– https://www.capitalone.com/bank/open-an-account/

3. Tax Lien Investing:

I guess Tax Lien is something that you might have never heard about before as not many people know about it and they don’t have it in other countries. I will explain to you in an easy way, Tax lien investing is a lesser-known strategy that involves purchasing liens on properties with unpaid property taxes. Local governments auction off these liens to investors. If the property owner fails to redeem the lien by paying the taxes plus interest, the investor may foreclose on the property. While tax lien investing offers the potential for high returns and security, there is a risk of redemption by the property owner, but the highest interest is up to 40% if you invest in Tax Lien you still have a high chance to get a good deal also.. It’s essential to conduct thorough research on local laws, property conditions, and consult with professionals before engaging in this investment strategy.

For clear explanations on tax lien investing, you can find informative videos on this YouTube channel: https://www.youtube.com/watch?v=JcAwqIfK0vo&t=0s

4. Stocks with Dividends:

If you know Warren Buffett the king of stock you will know how big success you can reach by jumping into this industry. Consider investing in stocks that offer dividends. Dividend stocks are shares of publicly traded companies that distribute a portion of their earnings to shareholders on a regular basis. When you invest in stocks with dividends, you become a partial owner of the company and receive dividend payments. It’s crucial to carefully time your stock purchases, taking into consideration the company’s performance and future prospects. It’s important to remember that stock prices can fluctuate, so it’s wise to focus on the end-of-year benefits rather than getting caught up in daily price changes.

Websites like https://us.etrade.com/home offer options for buying stocks. In fact, they even provide a $50 free sign-up bonus for the first 20 users: https://refer.etrade.net/2233tgi

5. Farmland Investment:

If you have an interest in the agricultural sector, investing in farmland can provide both passive income and potential appreciation. Purchasing agricultural land allows you to generate income through leasing. You can invest in a farm that you find promising or choose a farm that has a history of generating significant profits during harvest seasons. By researching such cases online, you can gain valuable insights into predicting your future passive income. Before making any investments, it’s essential to thoroughly assess factors such as location, soil quality, and market conditions.

https://acretrader.com/ can serve as a starting point for exploring opportunities in farmland investments.

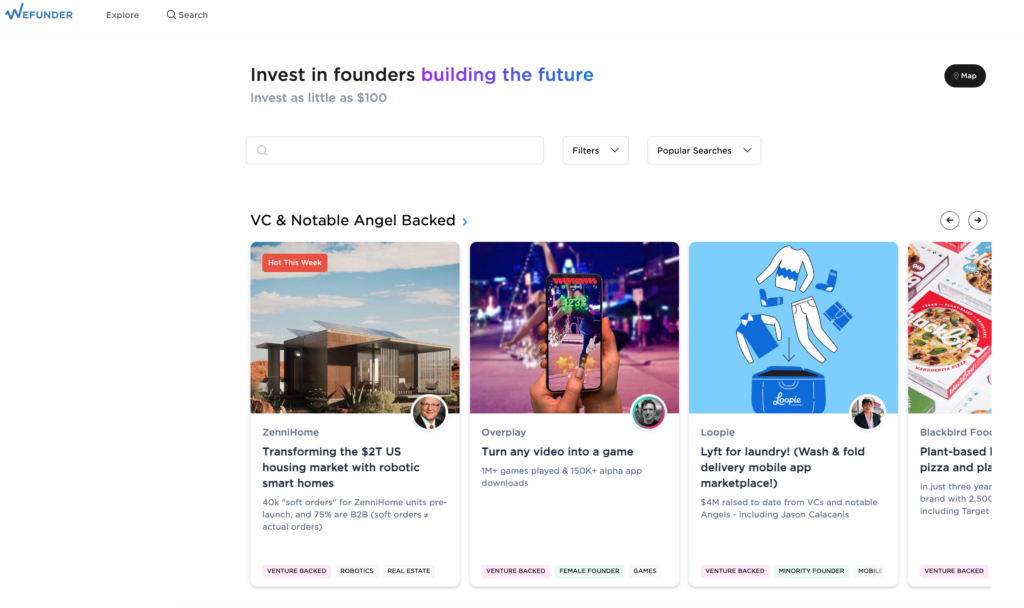

6. Startup Investments (WeFunder):

Investing in startups through platforms like WeFunder offers the potential for high returns, but it also comes with higher risk. WeFunder is an online platform that enables individual investors to contribute and become equity stakeholders in various startups, supporting the future of innovation. However, it’s important to conduct thorough research and exercise careful consideration due to the high-risk nature of these investments.

On the website https://wefunder.com/darrelwilson2/discount , you can find a variety of startup companies to explore and learn more about their potential before making any investment decisions.

7. Gold or Silver:

A classic way to generate passive income is investing in precious metals like gold or silver. While the value of these metals may not experience significant short-term rises, long-term trends have shown appreciation. Additionally, gold and silver often perform well during periods of inflation. Investing in gold and silver can provide a sense of security and serve as a hedge against economic uncertainties.

Websites like https://online.kitco.com/ can provide valuable information on the gold and silver market, helping you make informed investment decisions.

8. Affiliate Marketing:

Affiliate marketing is a smart and effective way to generate passive income online. By promoting products or services on your platform or website, you can earn commissions from resulting sales. It’s important to find your niche, promote products you genuinely believe in, and persuade others without resorting to excessive coercion.

Websites like https://www.youtube.com/watch?v=eJBHGYipOCk&t=0s provide helpful guidance on excelling in the field of affiliate marketing, offering valuable tips and strategies.

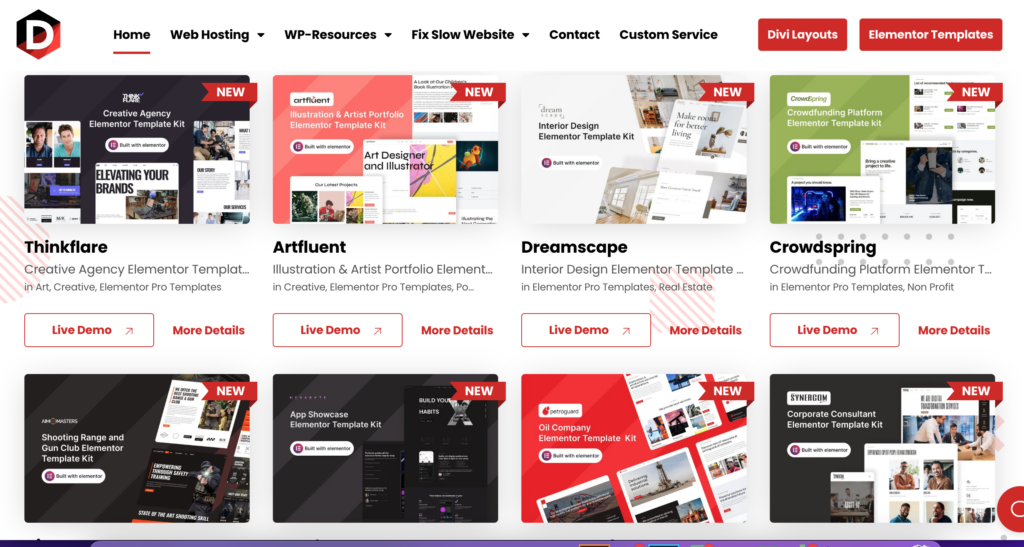

9. Selling Web Templates:

If you possess web design skills, selling web templates can be a lucrative opportunity for generating passive income. By creating customizable website designs compatible with popular Content Management System (CMS) platforms like WordPress, you can sell them through dedicated websites or online marketplaces. Providing support, documentation, and regular updates is essential to meet customer needs and ensure customer satisfaction.

Platforms such as https://www.etsy.com/ , https://themeforest.net/ , and https://creativemarket.com/ can help you monetize your design skills and reach a wider audience.

10. Loaning Out Your Money:

While lending money may seem risky, with good management and a reliable process, it can become a source of passive income. By allowing others to borrow your money and charging interest, you can earn additional income over time.

However, it’s crucial to use reputable platforms like https://www.prosper.com/ and carefully evaluate potential borrowers. This option should be approached cautiously and with proper risk management.

In addition to these ten strategies, I personally generate passive income through my YouTube channel and website, https://www.darrelwilson.com On my website, I sell web templates and engage in affiliate marketing. Furthermore, I also generate passive income from real estate investments. Exploring these avenues not only allows for a work-life balance but also provides more time to enjoy life and the freedom to spend quality time. It’s crucial to find the right method that aligns with your interests and goals in order to make passive income a reality.

So, is it better to work once and have your efforts generate income without requiring constant attention or excessive effort? Absolutely. By implementing these smart approaches to earning money and generating passive income, you can create a life of balance, allowing you to enjoy life to the fullest and spend precious moments with your people. It’s time to explore the best methods for generating passive income and make your dream life a reality. I believe that everyone can do it. You should start from now and you will enjoy the result in the near future.